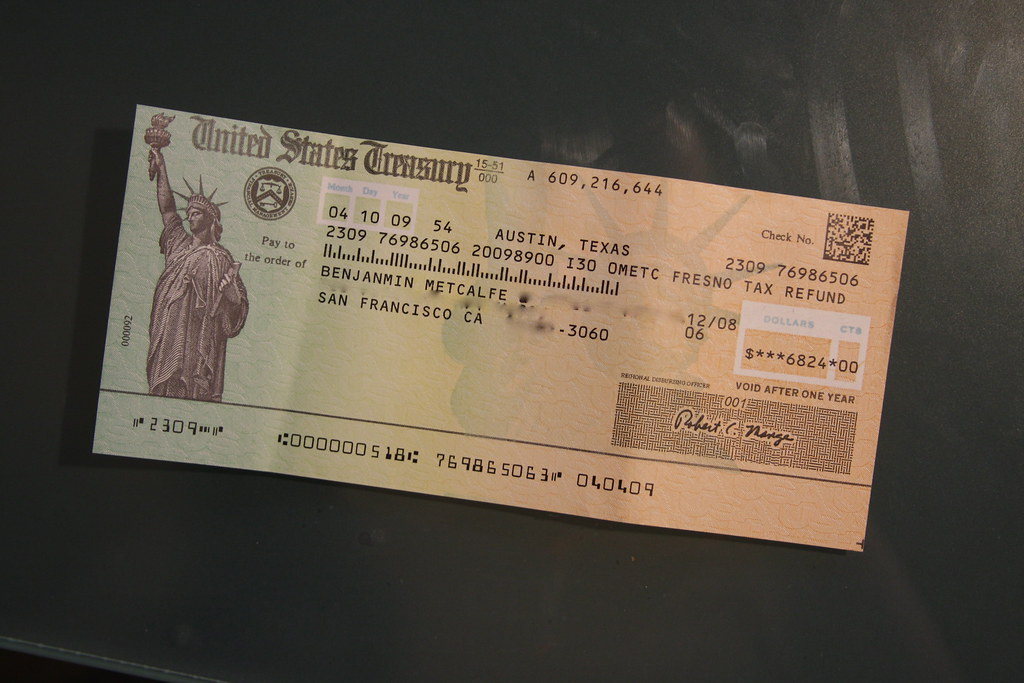

Us Casino Tax Refund

US Casino Tax Refund & Rebate

$150 Flat Rate! We Guarentee our Results! If you don’t get a gambling tax refund we don’t charge you any fee! We help Canadians and International vistors to the US recover a casino tax refund on the gambling winnings tax casinos are required to withhold.

Based on your answers to several questions, the e-File app will select and prepare the forms necessary to report your gambling winnings and losses on your tax return. However, if you want to learn more about how your gambling income affects your taxes, read on. Your Tax Year 2020 Return is due April 15, 2021. The national average for tax refunds is about $3,000, typically due because employers overwithhold federal income taxes. Trump’s request for $72 million is a few standard deviations above the mean. Casino Tax Recovery will: 1) determine how much of your the gambling tax is recoverable 2) file to get you a Individual Taxpayer Identification Number 3) help you recover any lost win slips (1042-S slips). Call Us Today: TOLL FREE at 1-888-272-5559 (US & CAN) Casino Tax Refunds for Canadians. Refund Management Services (RMS) will help you recover all or a porti.

Have you won at a casino slot machine or game and then realized that what you get to keep is less than you won? Unfortunately the casinos are required to withhold a 30% gambling winnings tax on certain gambling winnings. The good news is that for Canadians and some other international citizens* Casino Tax Recovery can help you recover this casino winnings tax. Often the full amount may be recovered with a US Tax Recovery service.

Casino Tax Recovery will:

1) determine how much of your the gambling tax is recoverable

2) file to get you a Individual Taxpayer Identification Number

3) help you recover any lost win slips (1042-S slips)

4) file all the necessary documentation to ensure that you get to as much of your casino tax refund as you are entitled to.

Canadian Us Casino Tax Refund

The best part is our service is guaranteed so we only charge a fee if you get your Casino Tax Refund.

The follow countries also qualify: Austria, Czech Republic, Denmark, Finland, France, Germany, Hungary, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Netherlands, Russian Federation, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Tunisia, Turkey, Ukraine, and the United Kingdom. These countries do not have to establish gambling losses in order to claim a full refund.

Claiming Gaming & Casino Tax Refunds for Over 20 Years

We’ve been claiming gaming and casino tax refunds since 1996. We are Canada’s longest standing withholding tax refund agency. Owned and operated by a Canadian Chartered Accountant, we are also Canada’s top choice for gaming and casino tax refunds.

We offer One Simple Step™ which means we are the easiest gaming and casino tax refund service around. You are only required to sign where indicated, and we file the multitudes of forms required on your behalf.

In order to make the refund process as easy as possible, we have formed relationships with most of the major gambling establishments. These relationships allow us to quickly retrieve your forms in the event that the forms you were issued were lost or damaged.

We Take Care of the Tax Recovery Process with the IRS

We have never been denied a rightful claim by the IRS. Despite this fact, we get customers every year who tried to claim their gaming or casino tax refund another way, often on their own. This decision led to mistakes in their application that caused the IRS to deny their claim.

Once a gaming or casino tax refund claim has been denied, the appeal process is even more complex than the claim. We leverage our special relationship with the IRS to navigate this process and reclaim as much as we can through an appeal.

One-Stop Gaming & Casino Tax Refund Agency

We are not only a gaming & casino tax refund agency, we are also an agent of the IRS. This means we are a one-stop refund agency, allowing you to take care of all the steps required for a gaming or casino tax refund in one place.

Gaming & Casino Tax Refund Eligibility

- You are a non-US resident.

- You have won taxable gaming income from specified gaming activity within the last three years.

- You have been issued an IRS Form 1042-S by the casino (if you have lost or misplaced these forms, we have developed relationships with casinos all across the US and can request them on your behalf).

- You have either a certified a) passport, OR a certified b) driver’s licence AND c) birth certificate

- You have qualified gaming losses (in accordance with the 1996 Canadian/US Tax Treaty).

Us Gambling Tax Refunds

After Winning How Much Time Do I Have To Get A Refund

The IRS has implemented a three-year filing rule. This rule allows one to go back three years to obtain a refund. Taxes on winnings prior to this period are statute-barred from any recovery. Most of our clients make their claim within days of returning back home. If you have won in the current year, refunds will be claimed at the beginning of the following taxation year.

What You Need to Know About The Tax On American Prize Winnings

Part of having a great time on any American vacation is the excitement of wagering, but before you spend all the money you win in the U.S., remember there’s a tax on prize winnings that goes as high as 30%.

Us Casino Tax Refund

If that number sounds high enough to put you off slot machines and even game shows when you’re down south, remember there are ways to get refunds through reputable Canadian firms that specialize in offsetting the tax on prize winnings you’d otherwise need to pay.

Once you understand that you can get some of that money back, of course you’ll want to know how fast that will happen. You should only deal with companies that are upfront on their websites about the turnaround time that’s often 12 to 15 weeks. Expect to get all the necessary information online like the fact that you can cut down the refund process time with a proper ITIN# and what your responsibilities are in the way of documentation.

Finally, you’ll need to find all the necessary eligibility information so you can proceed to get those refunds on the tax on prize winnings. First and foremost, you need to be a non U.S. resident.

Beat That Game Show Winning’s Tax Rate With RMS

Lots of Canadians and other international players are lured to the United States by the promise of big winnings on the game shows there. Still, contestants don’t always realize that when they win, so does the American tax man through the game show winnings tax rate that’s usually around 30%.

However, there’s no need to fret since a tax recovery company can help you get some of your money back from the Canadian side of the border. Of course you need to be sure the company that you’re considering is professional and knows all about getting you a game show winnings tax rate refund. Making sure they have the necessary experience is often about looking for testimonials on their website and a short and simple application form that helps you to get started.

Reputation and experience go hand in hand with these companies and if the company is founded and owned by someone that knows their stuff like a Chartered Accountant, all the better to get you the refund you deserve.

You need to do your part to get a refund and offset the game show winnings tax rate and a good company will let you know all of the eligibility requirements necessary so the process runs smoothly.

Apply now for free to have Canada’s #1 gaming & casino tax refund agency handle your refund.